About 3 Things To Avoid When Filing Bankruptcy

Financial debt settlement operates only if your personal debt is “unsecured.” This implies it isn’t backed up with collateral similar to a secured bank loan is. Unsecured financial debt is typically credit card or health-related debt.

Most creditors will find out about your bankruptcy even whenever they aren’t detailed with your types. Leaving a credit card debt out gained’t raise your likelihood of holding collateral or possibly a credit card.

Your upcoming step is to file the forms with the courtroom. This consists of visiting the courthouse and presenting your varieties for the clerk. You can’t be expecting legal help in the clerks, so make sure you have accomplished the sorts according to the instructions.

to concur without the need of offering consent to get contacted by automatic implies, text and/or prerecorded messages. Rates may possibly use.

Financial debt discharges are not unlimited. In the event you've filed for bankruptcy ahead of, you may not qualify right away. The waiting period will depend on the chapter you filed Beforehand plus the chapter you intend to file now.

Your credit history may possibly even Get well a lot quicker than when you experienced continued to wrestle at spending off your debt on your own.

There isn't a law necessitating you to possess the assistance of an attorney to file bankruptcy. But, seeking to file bankruptcy all on your own could leave you even worse off than when you started off. Bankruptcy law is complicated and everybody’s economic circumstance differs.

Mark Henricks has their website penned on mortgages, property and investing For most primary publications. He works from Austin, Texas, where by he engages in songwriting, wilderness backpacking, whitewater kayaking and triathlons when not reporting on private finance and modest organization.

However, it’s achievable to get an Original consultation with an attorney for no cost. You might get valuable facts from an hour or so-extended converse, which includes if visit their website you’re a very good applicant for bankruptcy.

Furthermore, Lawinfopedia also delivers free of charge authorized advice by amassing legal details and publishing content about trending lawful subjects.

Should you file bankruptcy before long immediately after getting new debt, the creditor could acquire concern with all your bankruptcy within the 341 meeting of creditors.

The impact on your credit score rating really should be modest. A personal debt management approach is not really credit card debt settlement, and that is A lot different and hurts your credit score score.

To put it differently, leaving your charge card out of your bankruptcy gained’t assist you to hold the card. Correct, a card that has a zero her explanation equilibrium isn’t technically a personal debt, so you click over here gained’t confront any penalties for leaving out a zero-stability card. Even so the lender will however close the account.

Mark Henricks has published on mortgages, property and view website investing For several major publications. He operates from Austin, Texas, in which he engages in songwriting, wilderness backpacking, whitewater kayaking and triathlons when not reporting on personalized finance and modest organization.

Jennifer Grey Then & Now!

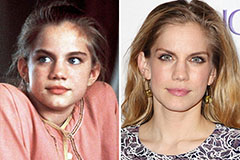

Jennifer Grey Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now!